Critical, Overlooked Steps – How to Prepare for Hurricane Season

July 24th, 2020

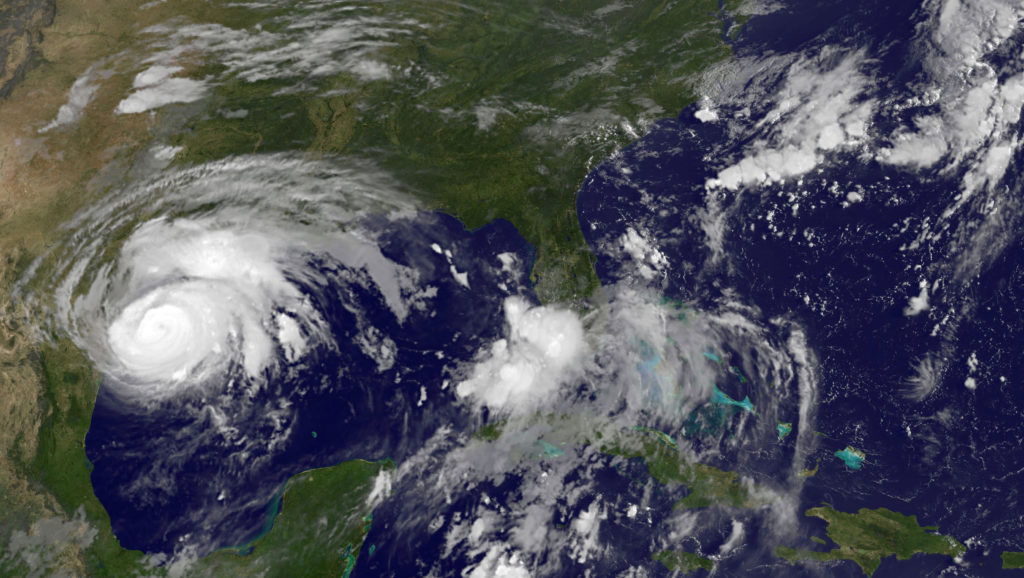

It has been nearly three years since the Texas coast was hit by Hurricane Harvey.

Individuals in the Atlantic, the Gulf of Mexico, and parts of the Southwest and Pacific Coast are at risk for high winds, heavy rains, and flooding Mid-May through November.

In addition to standard preparation measures for hurricanes – including covering windows, trimming trees and shrubs, installing a back-up generator, and securing unfastened furniture and items – two critical steps are often overlooked. To truly be prepared for hurricane season, residents of hurricane-prone regions must create a communication plan and review insurance coverage every hurricane season.

At Carlisle Insurance, we care about your safety first and foremost. Our most comprehensive and customized hurricane insurance is meaningless if you and your family aren’t safe. That’s why we offer the following suggestions for hurricane preparedness backed by superior customer service when claims are necessary.

Establish an Emergency Communication Plan

According to the American Red Cross, (https://www.redcross.org/) the internet – including online news sites and social media platforms – is the third-most popular way for Americans to gather emergency information and let their loved ones know they are safe. While the constant access afforded by the internet is a blessing for communicating updates, it is completely useless if, during a storm, phone lines, cell towers, internet services, and other technology go down.

Because technology cannot be counted on to weather a storm, it is important that you establish a communication plan beforehand to ensure you and your family are able to connect.

Incorporate the following steps into your emergency communication planning:

- Discuss the possibilities – Include all family members in discussions of possible disaster situations which may affect your area.

- Make a game plan – Establish designated areas to seek safety. Emergency meeting places should be safe and familiar for your family. Have several options to accommodate varying levels of impact: in your neighborhood, outside the neighborhood, and outside your city or town. Make sure everyone knows the address of the meeting places and discuss ways you would get there.

- Collect information – Gather paper copies of important contact information for your family members including all phone numbers, email, social media, school, medical facilities, doctors, and service providers.

- Share information – Make sure everyone carries a copy of the plan and relevant information and post one in a central location in your home such as your refrigerator or family bulletin board.

- Practice your plan – Have regular household meetings to review your emergency and communication plans, and meeting places after a disaster. Then practice the plan just like you would a fire drill.

Review Insurance Coverage Annually

Gaps in insurance coverage are often one of the most overlooked risk management measures in the wake of hurricanes.

Keep in mind that homeowners’ protection generally covers damage from wind, wind-driven rain, and water that enters your home through the doors, windows, and roof. Damage from water rising up from the ground, including storm surges and overflow from bodies of water require specialized flood coverage.

When Hurricane Harvey hit Texas in 2017, much of the damage sustained in the Houston area was a result of flooding, leaving many homeowners disappointed with their coverage.

Even if you don’t have flood insurance, it may be worthwhile to contact your insurance provider about possible reimbursement for living expenses if your home is uninhabitable, if you’ve incurred wind damage, and/or other non-flood related repair costs.

Depending on your location, there may be laws which prohibit rebuilding or requiring changes in the elevation of buildings above the flood or tidal level in flood zones and coastal hurricane areas. With this in mind, you should have your personal risk advisor review your flood insurance limits to adjust for increases dependent on additions or changes.

Get Hurricane Help

In addition to the tips for hurricane preparedness found at Ready.gov, (https://www.ready.gov/hurricanes) we have many resources and additional tips to keep your family safe during hurricane season. Contact (link to contact page on site) your personal risk advisor for more information. We are here to help you develop a family emergency plan. Together we can weather any storm.

Carlisle Insurance is a proud agency partner of Acrisure, (https://acrisure.com/) a top 10 global insurance broker. Our relationship with Acrisure allows us to provide our clients access to policies, resources, and expertise often outside the reach of stand-alone agencies. Along with competitive pricing, our service is backed by dedicated, local customer service.